Investments in Latvianforest property

Latvian Forest Company AB is a publicly traded, Swedish limited liability

company that offers private individuals and legal entities the opportunity

to invest in favorably valued forest property in Latvia.

Latvian Forest Company genomför företrädesemission om 27,3 Mkr för fortsatt expansion

FLAGGING MESSAGE Galjaden Invest AB has reduced its holding in Latvian Forest Company AB

THE BUYER WITH WHOM LATVIAN FOREST COMPANY AB HAS NEGOTIATED THE SALE OF ITS TWO LATVIAN SUBSIDIARIES HAS ANNOUNCED THAT IT DOES NOT INTEND TO COMPLETE THE CONTEMPLATED TRANSACTION.

LATVIAN FOREST COMPANY CONTINUES WORK TO COMPLETE THE SALE OF ITS SUBSIDIARIES IN LATVIA TO SWEDEN BASED, WELL ESTABLISHED COMPANY.

LATVIAN FOREST COMPANY ENTERS INTO LETTER OF INTENT WITH SWEDEN BASED, WELL ESTABLISHED COMPANY REGARDING THE SALE OF ITS SUBSIDIARIES IN LATVIA

LATVIAN FOREST COMPANY AB (PUBL.) COMPLETES PREPARATION ISSUE OF SEK 25 MILLION FOR CONTINUED EXPANSION

LATVIAN FOREST COMPANY AB (PUBL.) HAS FINISHED THE BUSINESS REGARDING THE PURCHASE OF ALL SHARES OF UAB SILUONA.

LATVIAN FOREST COMPANY AB (PUBL.) HAS SIGNED AN AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF A LITHUANIAN COMPANY OWNING 1,338 HECTARES OF LAND WITH 301,000 m³ OF LUMBER.

CORRECTION: UPDATE IN PREVIOUS PRESS RELEASE "CHANGED DATE FOR INTERIM REPORT JANUARY-JUNE 2021" REGARDING MAR CLASSIFICATION.

ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR LATVIAN FOREST COMPANY AKTIEBOLAG 2020

NOTICE TO ATTEND THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

Latvian Forest Company provide a rights issue of approximately 78.2 MSEK for continued expansion

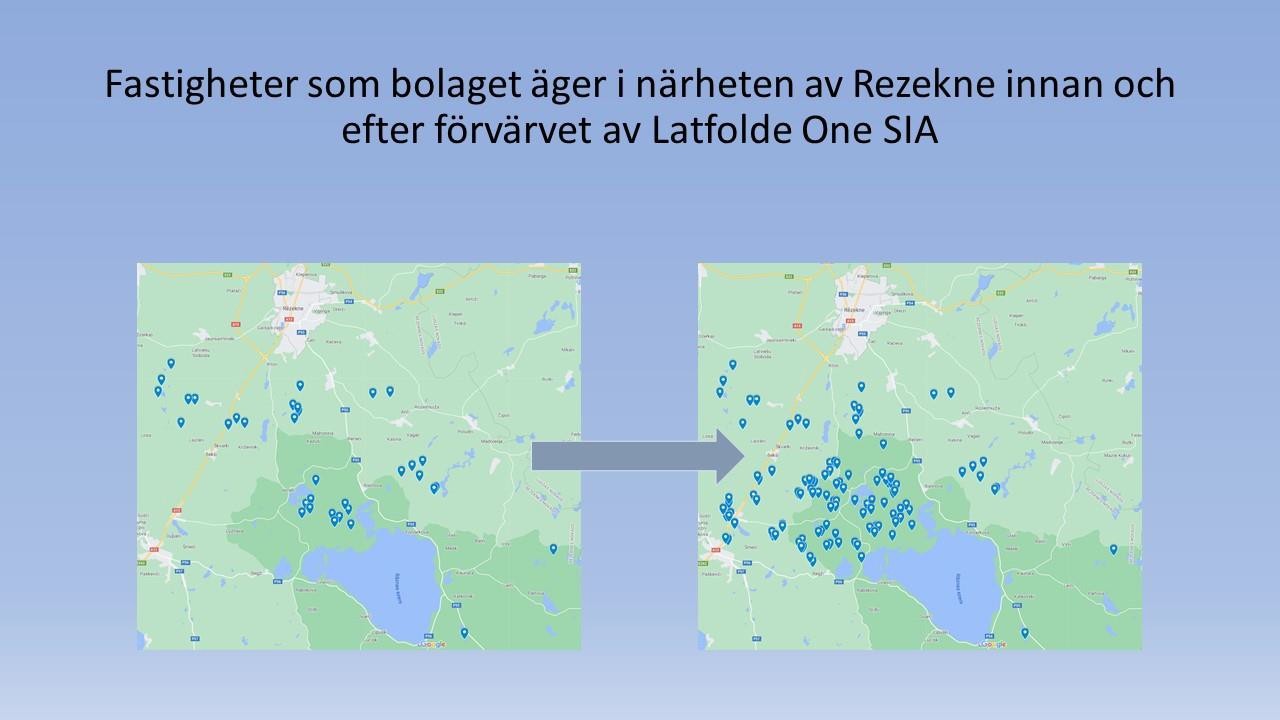

LATVIAN FOREST COMPANY AB (PUBL.) HAS COMPLETED THE TRANSACTION REGARDING THE PURCHASE OF ALL SHARES IN LATFOLDE AB

SUPPLEMENT - LATVIAN FOREST COMPANY AB (PUBL.) SIGNS CONDITIONAL PURCHASE AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF LATFOLDE AB

LATVIAN FOREST COMPANY AB (PUBL.) SIGNS CONDITIONAL PURCHASE AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF LATFOLDE AB

Interim report Jan-June 2020

Interim report Jan-June 2020

- Book value of fixed assets 12,264.8 (0) TEUR

- Equity amounts to 0.669 (1.154) EUR per share

- Earnings per share 0.024 (0.474) EUR

- Property holdings amount to 4,324* (0) hectares

- Timber volume estimated at 500,000* (0) cubic meters

- Net sales 103.7 (15.6) TEUR

- Operating profit -498.6 (0) TEUR

- Change in value, forest 1,080.7(0) TEUR

- Net profit 498.3 (9,726.4) (0) TEUR

LATVIAN FOREST COMPANY AB HAS SOLD 195.7 HECTARES OF FARMLAND AND A 2.3 HECTARE FARM.

Arbitration Institute has adjudicated on claims from former CEO Fredrik Zetterström

Regarding the company's former CEO Fredrik Zetterström, the Arbitration is expected to be on May 20, 2020.

Year- end report 2019

Period January-December 2019

- Book value of fixed assets 8,660 (24,574) TEUR

- Equity amounts to 0,665 (1,145) EUR per share)

- Property holdings amount to 3,816 (10,452) hectares

MINUTES HELD AT THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

Minutes kept at the Annual General Meeting of Latvian Forest Company AB (publ), org. 556789-0495, at 10.00, Monday, December 16, 2019 in Stockholm.

Read moreINTERIM REPORT JAN-SEP 2019

- Equity amounts to EUR 0.604 (1,125) per share

- Profit after financial items 9,523.4 (2,020.5) TEUR

- Earnings per share EUR 0.464 (0.099)

LATVIAN FOREST COMPANY AB HAS SIGNED A PURCHASE AGREEMENT FOR THE ACQUISITION OF 3,460 HECTARES OF FOREST AND AGRICULTURAL LAND IN LATVIA.

Parts of the acquisition have already been taken up and the remaining shall be taken later.

Read moreNOTICE OF EXTRAORDINARY GENERAL MEETING LATVIAN FOREST COMPANY AB (PUBL)

Shareholders wishing to participate in the Meeting shall be included in the share register kept by Euroclear Sweden AB ("VPC) and report their participation no later than Wednesday December 11, 2019.

Read moreFormer CEO and Board member Fredrik Zetterström has called for arbitration against Latvian Forest Company AB.

LFC informs that its past CEO and board member Fredrik Zetterström has called for arbitration against Latvian Forest Company AB regarding profit sharing corresponding to EUR 378,500.

Read moreINTERIM REPORT JAN-JUN 2019

All shares in the subsidiaries have been sold, leading to a surplus of 10,803 TEUR

- Equity amounts to EUR 1,154 (0.676) per share

- Profit after financial items 9,726.4 (18.3) TEUR

- Earnings per share EUR 0.474 (0.001)

Record day to receive dividends

Today, Monday, July 1, 2019, is the record day to receive a dividend. According to a resolution of the Annual General Meeting dividend to the shareholders shall be paid EUR 0.54 per share or a total of EUR 11 075 973.

Read moreAnnual Report and Consolidated Financial Statements for Latvian Forest Company Aktiebolag (publ)

INTERIM REPORT JAN-MAR 2019

Book value of fixed assets amounts to 24,733.2 (21,924.3) TEUR

- Equity amounts to 1,117 EUR (1,034) per share

- Earnings per share -0.028 (0.008) EUR

- Property holdings amount to 10,614 (9,665) hectares

NOTICE OF THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

Notice of the Annual General Meeting of Latvian Forest Company AB (publ).

Shareholders of Latvian Forest Company AB (publ), org. No. 556789-0495, (the "Company") is hereby invited to the Annual General Meeting on Thursday, June 27, 2019, at 10:00 a.m. in Galjaden Fastigheter's premises on Linnégatan 18 in Stockholm.

Read moreChairman of the Board Ted Alvenius leaves his post as board member and chairman of Latvian Forest Company AB with immediate effect.

LFC informs that Chairman of the Board, Ted Alvenius, is of a different opinion than the remaining Board of Directors regarding a transaction involving compensation for value increase in connection with the sale of all shares in the operating subsidiaries.

Read moreDisclosure Notice

Galjaden Invest AB has increased its holding in Latvian Forest Company AB to 20.03%.

Read morePress Release - sale of all shares in SIA Latvijas mezu kompanija and Baltic Forest IV SIA.

Latvian Forest Company has, in accordance with a resolution at the Extraordinary General Meeting on March 27, 2019, completed the sale of all shares in SIA Latvijas mezu kompanija and Baltic Forest IV SIA.

Read moreDisclosure Notice

Nils Robert Persson has increased his holding in Latvian Forest Company AB.

Read moreNOTICE FROM EXTRAORDINARY ANNUAL GENERAL MEETING

Latvian Forest Company AB (publ) held the Extraordinary Annual General Meeting on March 27, 2019. The meeting resolved on the sale of all shares in the operating subsidiaries SIA Latvijas Mezu Kompaniju and Baltic Forest IV SIA to SCA Mezs Latvija, SIA

Read moreSummons to Extraordinary General Meeting of shareholders in Latvian Forest Company AB (publ)

The shareholders of Latvian Forest Company AB (publ), Reg. No. 556789-0495 ("The Company") are hereby summoned to the Extraordinary General Meeting of shareholders to be held on Wednesday, March 27, 2019 at 10.00 in Galjaden Fastigheter premises on Linnégatan 18, Stockholm.

Read moreLatvian Forest Company undertecknar aktieöverlåtelseavtal med SCA Mezs Latvija

LATVIAN FOREST COMPANY SIGNS SHARE TRANSFER AGREEMENT WITH SCA MEZS LATVIA

Read moreBokslutskommuniké 2018

- Bokfört värde på mark- och skogstillgångar uppgår till 24.574 (21.323)TEUR

- Eget kapital uppgår till 1,145 (1,027) EUR per aktie

- Fastighetsinnehaven uppgår till 10.452 (9.599) hektar

- Virkesvolymen uppskattas till ca 1.015.000 (995.160) kubikmeter

Latvian Forest Company signs letter of intent with Svenska Cellulosa Aktiebolaget SCA with a view of selling the entire share capital of all its operating subsidiaries

Latvian Forest Company AB signs letter of intent with Svenska Cellulosa Aktiebolaget SCA with a view of selling the company’s operations by way of sale of all shares in the operating subsidiaries SIA Latvijas mezu kompanija and Baltic Forest IV, SIA. The total sale price is estimated to 26 000 000 Euro.

Read moreInterim Report January - September 2018

- Book value on land and forest assets of 23.840 (21.062) TEUR

- Owners’ Equity per share was 1,125 (0,979) EUR

- Property holdings of 10.357 (9.416) hectares

- Timber volume was 1.016.600 (960.000) cubic meter

Interim Report January - June 2018

- Book value on land and forest assets of 22.137 (20.850) TEUR

- Owners’ Equity per share was 1,047 (1,068) EUR

- Property holdings of 9.877 (9.368) hectare

- Timber volume was 1.034.000 (940.000) cubic meter

European Foresters' Orienteering Championships 2018

We at Latvian Forest Company are proud supporters of orienteering in Latvia.

Read moreInterim Report January - March 2018

- Book value on land and forest assets of 21.924,3 (20.829,8) TEUR

- Owners’ Equity per share was 1,034 (1,06) EUR

- Earnings per share 0,008 (0,0039) EUR

- Property holdings of 9.665 (9.368) hectare

Interim Report January - March 2017

- Book value on land and forest assets of 20.829,8 (19.228) TEUR

- Owners’ Equity per share was 1,06 (1,03) EUR

- Earnings per share was 0,0039 EUR

- Property holdings of 9.368 (8.590) hectare

Bronsstädet AB largest shareholder

Bronsstädet AB (556612-1124) has purchased 1.878.616 B-shares in Latvian Forest Company AB (publ). The ownership, after purchases, corresponds to 14.81 percent of capital and 14.01 percent of votes which makes Bronsstädet AB the largest shareholder in Latvian Forest Co.

Read moreAcquisitions will be completed

Following the completion of its due diligence analyses, the Latvian Forest Company AB has decided to complete the previously announced acquisitions.

Read more

Year-end report 2020

Year-end report 2020