Interim report January-March 2021

- Book value of fixed assets 17,966.4 (10,161.1) TEUR

- Equity amounts to 0.707 (1,117) EUR per share

- Earnings per share 0.007 (-0.028) EUR

- Property holdings amount to 5,670 (4,059) hectares

- Timber volume estimated at 650,000 (396,567) cubic meters

- Net sales 245.8 (14.8) TEUR

- Operating profit 122.8 (–361.4) TEUR

- Change in value, forest 61.1 (863.4) TEUR

- Net profit 151.7 (297.1) TEUR

(Data in parentheses refer to the corresponding period last year)

Latvian Forest Company AB (publ) is a Swedish listed company that invests in and conducts forestry on advantageously valued forest in Latvia. The three main foundations of the business are, in addition to the fact that forests are a sought-after real asset that grows on its own,

- an expected increase in the price levels of Latvian forest and agricultural properties.

- to create value increase through active forest management.

- to create value growth by building a larger property portfolio.

The expansion is financed by carrying out new rights issues in stages as properties are acquired and the business develops. Through Latvian Forest Company, shareholders become partners in many properties instead of an individual, which gives a good risk spread. The activities carried out in day-to-day forestry create the turnover needed to cover the company's costs over time and eventually generate a surplus.

Latvian Forest Company AB has Euro as accounting currency and all reporting takes place in Euro. Trading in the share on Spotlight Stock Market is in Swedish kronor.

Status & property holdings

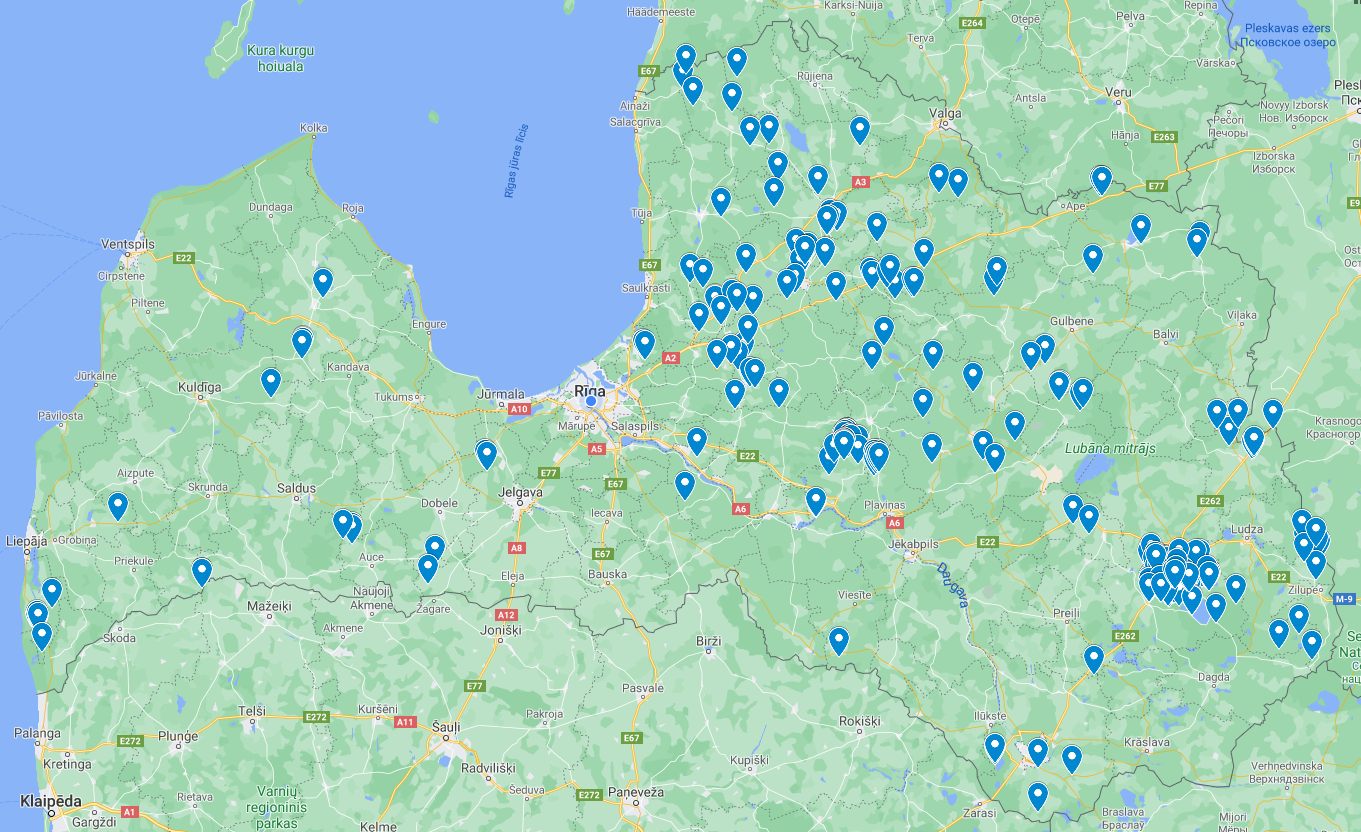

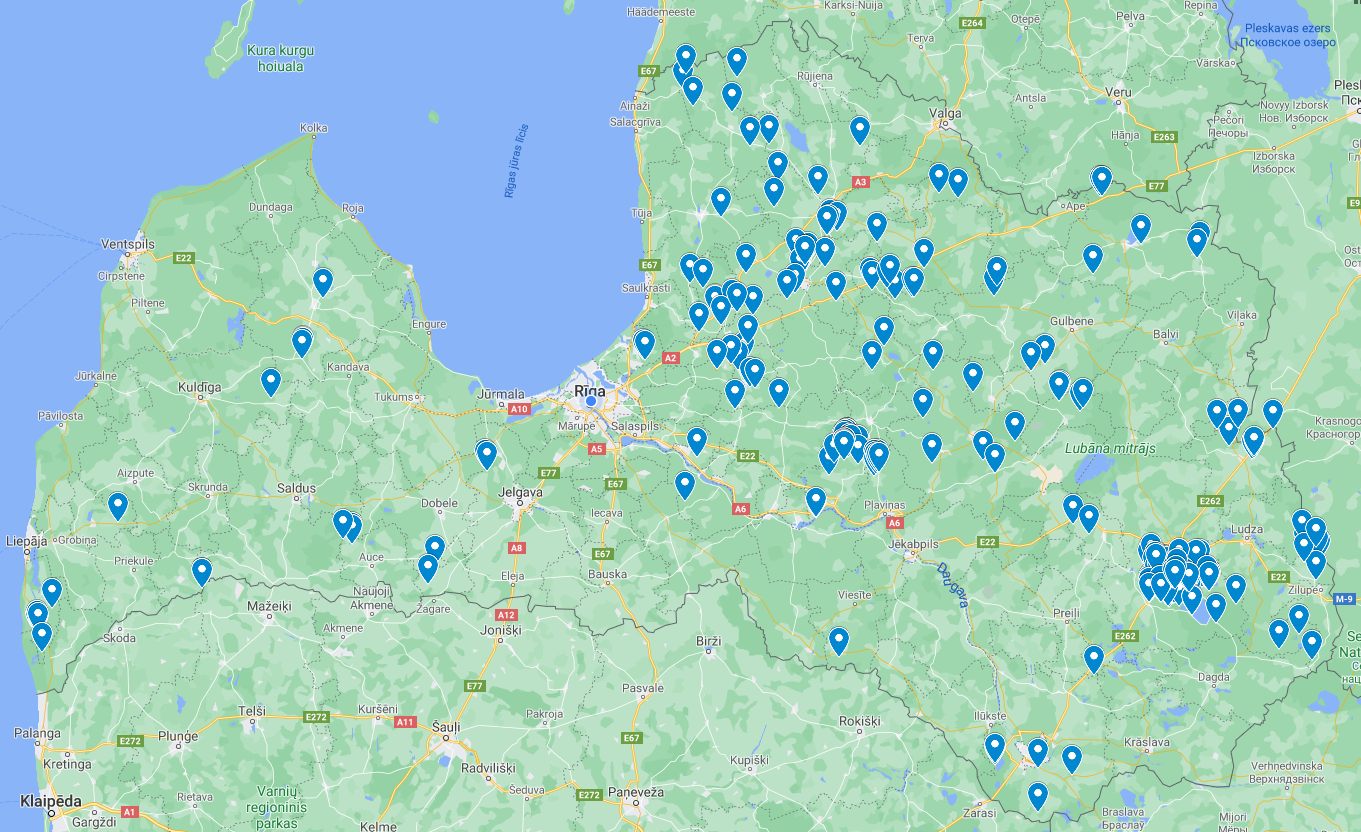

Investments in forest properties have been made continuously and the holdings amounted to a total of 5,670 (4,059) hectares at the end of the period. Of these, 3,636 (2,434) were forest and 2,034 (1,625) other land including 1,391 (1,306) hectares of agricultural land. At the same time, the total growing stock was estimated at approximately 650,000 (400,000) cubic meters after felling, property purchases and sales.

Of the 3,636 hectares owned by the company at the end of this period, the existing growing stock is estimated at approx. 640,000 m3. The company's management estimates that immediately fellable forest amounts to approx. 156,230 m3. Within the next 10 years, the company management expects to be able to fell 190,000 m3. According to the updated information the company's management estimate that there are 176 m3 of growing forest per hectare. This is approximately 25% more per hectare than in the portfolio divested to SCA last year. Almost 70 % of the company's holdings consist of land types corresponding to bonity classes IA, I and II. Only 0.6% of the company's holdings have management measures prohibited due to nature conservation restrictions. More than 70% of the growing stock consists of the three most important industrial types of wood: birch, pine, and spruce. The average acquisition cost of one cubic meter of timber stocks corresponds to EUR 21 including the cost of acquiring agricultural land.

(Map of existing property holdings)

At the end of 2019, the company acquired 1,175 hectares in connection with the purchase of the shares in KINI Land. So far, the company has managed to rent out 753 hectares to local farmers for EUR 70 per hectare per year excluding VAT. The remaining hectares, which consist of naturally afforested land, the company will gradually convert into forest land and carry out additional plantings of spruce. The existing growing stock has been inventoried as forest and added to the reported growing stock. The company management has decided to put 721 hectares of agricultural land for sale from the leased-out stock. The company has sold 160 hectares for 413 TEUR and entered into a sales agreement, secured by the advance deposition of an additional 169 hectares for 387 TEUR at the time of this report's publication. This means that the company has sold or entered into sales agreements for 522.72 hectares for the equivalent of 1,168 TEUR at the time of this report's publication.

Felling and clearing

During the first quarter, the company has sold harvesting rights or felled a total of 12,650 cubic meters, which is only part of this year's planned harvest volumes, i.e., sales of root records. The average felling price was EUR 18,94 per cubic meter with an income equivalent to 239 TEUR. The company has not cleared or carried out planting during the first quarter. About 9,709 m3 of the stock on two of the properties consists of grey alder that the company plans to convert into agricultural land. Income from the sale of felling rights was 140,000 EUR or 14,41 EUR/m3. The company acquired properties for a total of 617 TEUR with a total growing stock of 32,460 m3. The company begins tillage on the first 23 hectares before summer. The company has also sold 2,941 cubic meters in felling rights for 99.5 TEUR or 33.84 EUR/m3.

Turnover and profit

Sales in the first quarter amounted to 245.8 (14.8) TEUR and relate to revenues from harvesting volume, i.e., sales of root items, as well as lease income from agricultural land. Operating profit was 122.8 (-361.4) TEUR for the first quarter. Profit for the year was 151.7 (297.1) TEUR.

The estimated fair value of forest assets was 10,375 (4,022) TEUR. The total value of forest land and other land and the fair value of forest assets amounted to 17,553 (10,143) TEUR.

Otherwise, the result of normal costs for clearing, property-related costs such as new property measurements, inventories and stamping of stocks for felling, as well as certain costs associated with preparing felling, are affected.

External costs largely consist of purchased services related to forest management, other consultancy services such as accounting, auditing, legal advice, travel, rent and transport costs, etc. Variable costs for purchase commissions etc. have been recorded to some extent as part of the acquisition cost of the individual properties and in these cases not charged to profit or loss. Other variable remuneration for, inter alia, management and clearing-up is recorded under raw materials and supplies (previous cost of goods sold). Total costs in the first quarter were -122.8 (-361.4) TEUR.

Timber and forest property market

Prices rose for almost the entire timber and pulpwood range during the first quarter. According to Danske Bank's newsletter "Skog & Ekonomi" wood products are on the way into a new green super cycle for raw materials. A couple of the big investment banks are embarking on a long-term super cycle for commodities in general. But Danske Bank sees a green super cycle for wood products in particular. Several reasons work together: The pandemic's massive capital injections around the world provide major renovation and new building programs. In addition, it says that the wood-building country of the United States has a great pent-up need for housing. This is happening at the same time as the shift from fossil to renewable. The shift means that new constructions in solid wood take shares from concrete. This is especially true in Sweden, where apartment buildings with a wooden frame account for 20 percent of residential construction. Sawn timber has become red hot, both on the world market and in Sweden. This can be seen by price increases occurring in the middle of winter when construction halts. This may be because many players build on their inventories and predict higher demand from the second quarter 2021.

Although all global trends point to prices going up, the Latvian market has been significantly less predictable. This may be because the Latvian market is driven by spot prices. The demand and price for birch veneer stocks has decreased by about 10% compared to December 2020. The prices of firewood decreased by 10 % in the first quarter of 2021 compared to 2020. The price of chips decreased by 15 % since the first quarter because of a more transparent multi-operator market.

The demand and the price of birch pulpwood increased by 12% compared to the first quarter of 2020. The price of coniferous wood rose by 25% compared to the same period last year. The same applies to deciduous trees. Prices for coniferous pulpwood have stagnated and not changed throughout 2020 and the first quarter of 2021.

The European Parliament has launched the development of a new forestry strategy to achieve a more environmentally friendly direction within the Community. In practical terms, this will mean that forest owners will receive higher compensation for the nature protection restrictions.

Financing

The company has borrowed 15 million MSEK market terms from Latvian Forest's shareholder Galjaden Fastigheter AB to finance the purchase of additional forest properties. The loans mature in full on August 25, 2021.

Financing strategy

Following comments from and probing among shareholders and potential investors, the Board of Directors has decided that future financing in the form of new issues will primarily take place within the framework of new issues with preference for existing shareholders. However, this does not prevent targeted issues from being carried out, among other things, in the case of the acquisition of property portfolios or in specific situations where a directed issue may be required. The aim is that existing shareholders should not be disadvantaged if a directed issue is carried out.

Share

At the end of the period, the share capital amounted to 2,297,307 EUR divided into 80,000 Class A shares and 20,431,061 Class B shares. Class A shares represent ten votes and Class B shares one vote each. Each share has a quota value of EUR 0.112 in share capital. According to the latest data obtained, the five largest shareholders in terms of voting rights control 67.6% of the capital and 67.2% of the votes.

Significant events after the end of the period

On April 12, 2021, the Board of Directors resolved to carry out a rights issue of Class B shares pursuant to authorization from the Annual General Meeting on June 29, 2020. The rights issue comprises a total of approximately 78.2 MSEK and is aimed at financing continued expansion through the acquisition of additional forest properties. Latvian Forest Company AB provides 78.2 MSEK before issue costs. In total, the issue was subscribed for at 138.8 percent, of which 98.7 percent was subscribed for with subscription rights and 40.1 percent without subscription rights.

The funds that are provided through the rights issue are mainly intended to be used as set out below.

Issue volume 78,198 MSEK

Estimated issue costs 1,523 MSEK

Repayment of loans plus estimated interest rate 19,798 MSEK

New investment in forest properties 56,877 MSEK

In accordance with the principles set out in the prospectus, the Board of Directors has allotted all the subscribers all the shares in the issue, a total of 12,819,413 Class B shares, of which 12,649,695 Class B shares subscribed for with preferential rights and 169,718 Class B shares without preferential rights. Once the rights issue has been registered with the Swedish Companies Registration Office, the Company's share capital will amount to EUR 3,733,124.56 (rounded) and the total number of shares to 33,330,474 of them, of which 33,250,474 Class B shares.

At the time of this report, property holdings amount to 5,612 hectares. At the same time, the total growing stock was estimated at approximately 660,000 cubic meters after completion of felling and property purchases and sales.

Next report

The report for the period January to June 2021 is scheduled to be published on August 23, 2021.

Annual Report and Annual General Meeting

Notice of the Annual General Meeting on 30 June 2021 has taken place and the annual report and related material will be available no later than two weeks before the meeting.

About this report

This report has not been subject to special scrutiny by the company's auditor.

Stockholm, 2021-05-31

Board

For further information please contact

Aleksandrs Tralmaks, CEO

+37129203972

info@latvianforest.se

Or visit our website: www.latvianforest.se

Interim report January-March 2021.pdf

Latvian Forest Company offentliggör emissionsmemorandum

10.04.2024

Read more

Latvian Forest Company genomför företrädesemission om 27,3 Mkr för fortsatt expansion

02.04.2024

Read more

Ändrat datum för offentliggörande av bokslutskommuniké 2023

19.02.2024

Read more

Interim report Jan-Sept. 2023

22.11.2023

Read more

FLAGGING MESSAGE Galjaden Invest AB has reduced its holding in Latvian Forest Company AB

20.09.2023

Read more

Interim report Jan-June 2023

25.08.2023

Read more

COMMUNIQUÉ FROM THE ANNUAL GENERAL MEETING

26.06.2023

Read more

NOTICE LFC ANNUAL GENERAL MEETING 2023 - MAY 30, 2023

30.05.2023

Read more

Interim report January-March 2023

24.05.2023

Read more

THE BUYER WITH WHOM LATVIAN FOREST COMPANY AB HAS NEGOTIATED THE SALE OF ITS TWO LATVIAN SUBSIDIARIES HAS ANNOUNCED THAT IT DOES NOT INTEND TO COMPLETE THE CONTEMPLATED TRANSACTION.

29.04.2023

Read more

LATVIAN FOREST COMPANY CONTINUES WORK TO COMPLETE THE SALE OF ITS SUBSIDIARIES IN LATVIA TO SWEDEN BASED, WELL ESTABLISHED COMPANY.

17.04.2023

Read more

Changed date for Year-end report 2022

20.02.2023

Read more

LATVIAN FOREST COMPANY ENTERS INTO LETTER OF INTENT WITH SWEDEN BASED, WELL ESTABLISHED COMPANY REGARDING THE SALE OF ITS SUBSIDIARIES IN LATVIA

15.02.2023

Read more

Interim report Jan-Sept. 2022

23.11.2022

Read more

New date for Interim Report January-September 2022

14.11.2022

Read more

Interim report Jan-June 2022

22.08.2022

Read more

COMMUNICATION FROM ANNUAL GENERAL MEETING

30.06.2022

Read more

Interim Report January - March 2022

27.05.2022

Read more

Last day for trading in BTA B is 2022-03-11

09.03.2022

Read more

CHANGED DATE FOR YEAR-END REPORT 2021

18.02.2022

Read more

LATVIAN FOREST COMPANY'S PREMIUM ISSUE SUBSCRIBED

01.02.2022

Read more

Correction: Carry out a rights issue of SEK 25 million for continued expansion

07.01.2022

Read more

LATVIAN FOREST COMPANY AB (PUBL.) COMPLETES PREPARATION ISSUE OF SEK 25 MILLION FOR CONTINUED EXPANSION

07.01.2022

Read more

LATVIAN FOREST COMPANY AB (PUBL.) HAS FINISHED THE BUSINESS REGARDING THE PURCHASE OF ALL SHARES OF UAB SILUONA.

02.12.2021

Read more

CHANGED DATE FOR INTERIM REPORT JAN-SEPT 2021

12.11.2021

Read more

LATVIAN FOREST COMPANY AB (PUBL.) HAS SIGNED AN AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF A LITHUANIAN COMPANY OWNING 1,338 HECTARES OF LAND WITH 301,000 m³ OF LUMBER.

01.11.2021

Read more

Interim report Jan-June 2021

30.08.2021

Read more

CORRECTION: UPDATE IN PREVIOUS PRESS RELEASE "CHANGED DATE FOR INTERIM REPORT JANUARY-JUNE 2021" REGARDING MAR CLASSIFICATION.

23.08.2021

Read more

ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR LATVIAN FOREST COMPANY AKTIEBOLAG 2020

03.08.2021

Read more

COMMUNICATION FROM ANNUAL GENERAL MEETING

30.06.2021

Read more

NOTICE TO ATTEND THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

31.05.2021

Read more

Latvian Forest Companys företrädesemission registrerad

27.05.2021

Read more

Latvian Forest Company's rights issue oversubscribed

07.05.2021

Read more

LATVIAN FOREST COMPANY PUBLISHES PROSPECTUS

22.04.2021

Read more

Latvian Forest Company provide a rights issue of approximately 78.2 MSEK for continued expansion

12.04.2021

Read more

Changed release date for Interim Report Jan-Mar 2021

12.04.2021

Read more

Interim report Jan-Sept. 2020

30.11.2020

Read more

AMENDED DATE OF INTERIM REPORT JAN-SEPT. 2020

19.11.2020

Read more

LATVIAN FOREST COMPANY AB (PUBL.) HAS COMPLETED THE TRANSACTION REGARDING THE PURCHASE OF ALL SHARES IN LATFOLDE AB

30.10.2020

Read more

LATVIAN FOREST COMPANY AB BORROWS 1.1 MEUR FROM SWEDBANK

23.10.2020

Read more

SUPPLEMENT - LATVIAN FOREST COMPANY AB (PUBL.) SIGNS CONDITIONAL PURCHASE AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF LATFOLDE AB

18.09.2020

Read more

LATVIAN FOREST COMPANY AB (PUBL.) SIGNS CONDITIONAL PURCHASE AGREEMENT REGARDING THE PURCHASE OF ALL SHARES OF LATFOLDE AB

18.09.2020

Read more

Interim report Jan-June 2020

26.08.2020

Interim report Jan-June 2020

- Book value of fixed assets 12,264.8 (0) TEUR

- Equity amounts to 0.669 (1.154) EUR per share

- Earnings per share 0.024 (0.474) EUR

- Property holdings amount to 4,324* (0) hectares

- Timber volume estimated at 500,000* (0) cubic meters

- Net sales 103.7 (15.6) TEUR

- Operating profit -498.6 (0) TEUR

- Change in value, forest 1,080.7(0) TEUR

- Net profit 498.3 (9,726.4) (0) TEUR

Read more

LATVIAN FOREST COMPANY AB HAS SOLD 195.7 HECTARES OF FARMLAND AND A 2.3 HECTARE FARM.

20.07.2020

Read more

COMMUNIQUÉ FROM THE ANNUAL GENERAL MEETING

29.06.2020

Read more

NOTICE OF ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

29.06.2020

Read more

Interim report Jan-Mar 2020

25.05.2020

Read more

Arbitration Institute has adjudicated on claims from former CEO Fredrik Zetterström

20.05.2020

Read more

Regarding the company's former CEO Fredrik Zetterström, the Arbitration is expected to be on May 20, 2020.

28.04.2020

Read more

Year- end report 2019

20.02.2020

Period January-December 2019

- Book value of fixed assets 8,660 (24,574) TEUR

- Equity amounts to 0,665 (1,145) EUR per share)

- Property holdings amount to 3,816 (10,452) hectares

Read more

MINUTES HELD AT THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

20.12.2019

Minutes kept at the Annual General Meeting of Latvian Forest Company AB (publ), org. 556789-0495, at 10.00, Monday, December 16, 2019 in Stockholm.

Read more

INTERIM REPORT JAN-SEP 2019

22.11.2019

- Equity amounts to EUR 0.604 (1,125) per share

- Profit after financial items 9,523.4 (2,020.5) TEUR

- Earnings per share EUR 0.464 (0.099)

Read more

LATVIAN FOREST COMPANY AB HAS SIGNED A PURCHASE AGREEMENT FOR THE ACQUISITION OF 3,460 HECTARES OF FOREST AND AGRICULTURAL LAND IN LATVIA.

12.11.2019

Parts of the acquisition have already been taken up and the remaining shall be taken later.

Read more

NOTICE OF EXTRAORDINARY GENERAL MEETING LATVIAN FOREST COMPANY AB (PUBL)

12.11.2019

Shareholders wishing to participate in the Meeting shall be included in the share register kept by Euroclear Sweden AB ("VPC) and report their participation no later than Wednesday December 11, 2019.

Read more

Former CEO and Board member Fredrik Zetterström has called for arbitration against Latvian Forest Company AB.

08.10.2019

LFC informs that its past CEO and board member Fredrik Zetterström has called for arbitration against Latvian Forest Company AB regarding profit sharing corresponding to EUR 378,500.

Read more

INTERIM REPORT JAN-JUN 2019

23.08.2019

All shares in the subsidiaries have been sold, leading to a surplus of 10,803 TEUR

- Equity amounts to EUR 1,154 (0.676) per share

- Profit after financial items 9,726.4 (18.3) TEUR

- Earnings per share EUR 0.474 (0.001)

Read more

Record day to receive dividends

01.07.2019

Today, Monday, July 1, 2019, is the record day to receive a dividend. According to a resolution of the Annual General Meeting dividend to the shareholders shall be paid EUR 0.54 per share or a total of EUR 11 075 973.

Read more

Annual Report and Consolidated Financial Statements for Latvian Forest Company Aktiebolag (publ)

03.06.2019

Read more

INTERIM REPORT JAN-MAR 2019

24.05.2019

Book value of fixed assets amounts to 24,733.2 (21,924.3) TEUR

- Equity amounts to 1,117 EUR (1,034) per share

- Earnings per share -0.028 (0.008) EUR

- Property holdings amount to 10,614 (9,665) hectares

Read more

NOTICE OF THE ANNUAL GENERAL MEETING OF LATVIAN FOREST COMPANY AB (PUBL)

23.05.2019

Notice of the Annual General Meeting of Latvian Forest Company AB (publ).

Shareholders of Latvian Forest Company AB (publ), org. No. 556789-0495, (the "Company") is hereby invited to the Annual General Meeting on Thursday, June 27, 2019, at 10:00 a.m. in Galjaden Fastigheter's premises on Linnégatan 18 in Stockholm.

Read more

Chairman of the Board Ted Alvenius leaves his post as board member and chairman of Latvian Forest Company AB with immediate effect.

20.05.2019

LFC informs that Chairman of the Board, Ted Alvenius, is of a different opinion than the remaining Board of Directors regarding a transaction involving compensation for value increase in connection with the sale of all shares in the operating subsidiaries.

Read more

Disclosure Notice

16.04.2019

Galjaden Invest AB has increased its holding in Latvian Forest Company AB to 20.03%.

Read more

Press Release - sale of all shares in SIA Latvijas mezu kompanija and Baltic Forest IV SIA.

08.04.2019

Latvian Forest Company has, in accordance with a resolution at the Extraordinary General Meeting on March 27, 2019, completed the sale of all shares in SIA Latvijas mezu kompanija and Baltic Forest IV SIA.

Read more

Disclosure Notice

29.03.2019

Nils Robert Persson has increased his holding in Latvian Forest Company AB.

Read more

NOTICE FROM EXTRAORDINARY ANNUAL GENERAL MEETING

27.03.2019

Latvian Forest Company AB (publ) held the Extraordinary Annual General Meeting on March 27, 2019. The meeting resolved on the sale of all shares in the operating subsidiaries SIA Latvijas Mezu Kompaniju and Baltic Forest IV SIA to SCA Mezs Latvija, SIA

Read more

Summons to Extraordinary General Meeting of shareholders in Latvian Forest Company AB (publ)

13.03.2019

The shareholders of Latvian Forest Company AB (publ), Reg. No. 556789-0495 ("The Company") are hereby summoned to the Extraordinary General Meeting of shareholders to be held on Wednesday, March 27, 2019 at 10.00 in Galjaden Fastigheter premises on Linnégatan 18, Stockholm.

Read more

Latvian Forest Company undertecknar aktieöverlåtelseavtal med SCA Mezs Latvija

08.03.2019

LATVIAN FOREST COMPANY SIGNS SHARE TRANSFER AGREEMENT WITH SCA MEZS LATVIA

Read more

Bokslutskommuniké 2018

22.02.2019

- Bokfört värde på mark- och skogstillgångar uppgår till 24.574 (21.323)TEUR

- Eget kapital uppgår till 1,145 (1,027) EUR per aktie

- Fastighetsinnehaven uppgår till 10.452 (9.599) hektar

- Virkesvolymen uppskattas till ca 1.015.000 (995.160) kubikmeter

Read more

Latvian Forest Company signs letter of intent with Svenska Cellulosa Aktiebolaget SCA with a view of selling the entire share capital of all its operating subsidiaries

04.02.2019

Latvian Forest Company AB signs letter of intent with Svenska Cellulosa Aktiebolaget SCA with a view of selling the company’s operations by way of sale of all shares in the operating subsidiaries SIA Latvijas mezu kompanija and Baltic Forest IV, SIA. The total sale price is estimated to 26 000 000 Euro.

Read more

Interim Report January - September 2018

23.11.2018

- Book value on land and forest assets of 23.840 (21.062) TEUR

- Owners’ Equity per share was 1,125 (0,979) EUR

- Property holdings of 10.357 (9.416) hectares

- Timber volume was 1.016.600 (960.000) cubic meter

Read more

Interim Report January - June 2018

23.08.2018

- Book value on land and forest assets of 22.137 (20.850) TEUR

- Owners’ Equity per share was 1,047 (1,068) EUR

- Property holdings of 9.877 (9.368) hectare

- Timber volume was 1.034.000 (940.000) cubic meter

Read more

Come follow us on Instagram!

17.08.2018

Come follow us on Instagram

Read more

European Foresters' Orienteering Championships 2018

01.08.2018

We at Latvian Forest Company are proud supporters of orienteering in Latvia.

Read more

Interim Report January - March 2018

24.05.2018

- Book value on land and forest assets of 21.924,3 (20.829,8) TEUR

- Owners’ Equity per share was 1,034 (1,06) EUR

- Earnings per share 0,008 (0,0039) EUR

- Property holdings of 9.665 (9.368) hectare

Read more

Interim Report January - March 2017

22.05.2017

- Book value on land and forest assets of 20.829,8 (19.228) TEUR

- Owners’ Equity per share was 1,06 (1,03) EUR

- Earnings per share was 0,0039 EUR

- Property holdings of 9.368 (8.590) hectare

Read more

Bronsstädet AB largest shareholder

23.09.2014

Bronsstädet AB (556612-1124) has purchased 1.878.616 B-shares in Latvian Forest Company AB (publ). The ownership, after purchases, corresponds to 14.81 percent of capital and 14.01 percent of votes which makes Bronsstädet AB the largest shareholder in Latvian Forest Co.

Read more

Acquisitions will be completed

04.03.2014

Following the completion of its due diligence analyses, the Latvian Forest Company AB has decided to complete the previously announced acquisitions.

Read more